The world’s most valuable car is a Mercedes-Benz. Where will your investment money go?

Kieran Rennie speaks to a number of key industry players on behalf of SLSHOP.

It isn’t just the staggering sales figure; it’s also the massive price difference between this new record and the old one. Mercedes Benz hasn’t just moved the needle; they’ve broken the pin at 8000 rpm mark.

The 1956 Mercedes-Benz 300 SLR – of which only two were made – sold for a jaw-dropping $142.7 million, more than doubling the old record. The previous champion, a 1964 Ferrari GTO, held the title at $70 million. The Italian manufacturer had been top of the pops for some time with a succession of (mainly) 250 GTOs. The 300 SLR has landed a knockout blow the likes of which no one, perhaps not even the Mercedes Benz Museum – who put the car up for sale – could have predicted.

While cars like the 300 SLR – and the associated asking prices – exist almost entirely in Bezos-Musk-Ville, it is a significant moment for the automotive landscape. It stirs interest, ignites conversations, and it affects values.

RM Sotheby’s, who facilitated the sale, are, unsurprisingly, still basking in the glory. Peter Haynes, Marketing and Communications Director EMEA, says, “Words can’t really do justice to the importance and significance of this sale. It’s reasonable to say that nobody ever imagined that this car would ever be offered for sale, so for Mercedes-Benz to ask RM Sotheby’s to conduct the auction was an absolute honour. It is clear that the sale of this car is a game-changer in the collector car market and has, naturally, forced people to re-assess the values that can be attributed to cars which sit amongst the rarest and most historically significant examples in the world. But it may be many years before we see a sale of another car that can compare to this remarkable event.”

For some time now, classic cars have been considered legitimate investments. In the same way that one might buy a rare painting by a famous artist, a rare and sought-after car can be fun to own and financially prudent. Whether you’re a member of the world’s financial elite or just someone with a bit of expendable income looking to be smart with your money, buying the right classic car is a sensible economic strategy. And it doesn’t have to be a multi-million dollar, uber-rare Mercedes or Ferrari. An early model VW Beetle, as an example, bought for say £7000 ten years ago, might be worth double that today if you’ve managed to keep the car in good nick.

The trick is, as with any investment, finding the right car. In the case of the Uhlenhaut 300 SLR – named after the then head of testing at Mercedes Benz, Rudolph Uhlenhaut – or a Ferrari 250 GTO, the car’s rarity, its motorsport heritage, and the brand’s providence make it an easy pick. But that ‘certainly’ comes at a price. How does one find an affordable car that offers some degree of confidence in its future value?

The recent inaugural Concourse On Savile Row, held on that famous, high-end men’s fashion street in London, had on display an impressive selection of future, contemporary and classic cars. Many of these cars were limited-production models made even more exclusive by independent automotive design houses. From both a financial and a passion perspective, there is a growing appetite for cars that are already pricy from the manufacturer, customised to bespoke specifications – the cost of which can often double the purchase price. These owners – these investors – are confident that the one-off nature of their new car will retain and even increase its value based on its uniqueness.

When asked his opinion about the sale of the 300 SLR, Geoff Love, Managing Director of Hothouse Media and co-organiser of the Concourse, had this to say: “The price paid for the Mercedes-Benz reflected the unique nature of the individual car. In my view, it will challenge the valuations of the most important classic cars that transcend automotive culture and move them into fine art. It will raise the bar for the absolute very best cars of real provenance rather than have a general impact on all classic cars. It may move the general value of certain classic Mercedes, but the real winners will be those rare cars that are rolling works of art.”

Rudolph Uhlenhaut

There is no doubt that beauty, style, grace and sex appeal all play a part in a car’s desirability. And even though beauty is in the eye of the beholder, and sometimes even the beer holder, there are some cars that the vast majority of people, car lovers or not, agree would look great in their driveway. There’s no doubt that the estimated 5000 folks who attended Concourse On Savile Row found reason to stop and stare and drool.

Disappointingly, there were no SLs or other classic or contemporary Mercedes-Benz’s on display at the Concourse. We now live in a world where the ‘world’s most valuable car’ is a Mercedes-Benz SL. Any collection or display of desirable cars feels a little empty without a three-pointed star on the grounds. One suspects that if the timing of event wasn’t as close as it was to the record-breaking auction of the 300 SLR, that we may well have seen a slightly different line-up.

Hagerty is a world-renowned classic car insurer and valuations expert. Their Classic Index tracks the values of 50 individual cars. This index analyses the ‘gold standard’ landscape and can, therefore, to a degree, give solid insights into the future developments of the U.K. and world markets.

John Mayhead, Editor of the UK Hagerty Price Guide, said, “In general, the old ‘gold standard’ classics have been either flat or reduced in value: pre-1970s Aston Martins, E-Type Jaguars, Jensen Interceptors, etc. have all slipped back, except very special cars (matching numbers, interesting provenance, originality, good spec and colour). Hagerty believes that if you were of the generation that remembers the impact a DB5 or an E-Type had when new, you’ve either reached the point in your life when you can afford one, or you never will.”

We asked John about his views on future classic Mercedes-Benz models. He said: “Early AMG Mercedes saloons (C36, C43, E55, etc.) are likely to rise if in good condition. Similarly, any well-maintained Black Series cars are already very collectable. SLS and SLR McLarens have both recently been added to the Hagerty Price Guide for the same reason.”

Mayhead feels that the cars that are growing in value – apart from the unicorns – are vehicles relevant to the generation which is enthusiastic about spending their money today. The baby boomers have perhaps already bought the cars they want. Gen X and even the millennials have their faces planted to the windows of today’s digital showrooms. It’s their hero cars, therefore, which are gaining momentum.

Mayhead also says, “At the top end, there seems to be a US-led surge in the values of 300SL Gullwing and Roadsters. Values dipped just before the pandemic but have rallied strongly. We’ve seen a 22% increase in average Gullwing value (to £1.131M) in the last three years.”

“The W121 190SL has also performed extremely well with a rise of 18% over the same period (avg. now £119,000). W113 230SL and 280SL have been increasing steadily but feel undervalued: they combine classic styling with a driving practicality that puts them in a very usable category.”

With the W113 SL, The Pagoda, set for its 60th anniversary next year, right now could be the perfect time to snap one up. The 280SL has always been the ‘one to buy’, but both the 250SL and the 230SL are now gaining momentum.

We also asked John for final comments on the sale of the 300 SLR and whether moments like this will impact overall prices, “We think not directly. Industry insiders suggest that this is a strong play by MB, though – to make the point that their car is the most valuable in the world. Coming so close to the release of the AMG One (Hypercar), it is a statement of intent to the opposition. This is such a high level of sale that it is unlikely to directly increase other MB prices, but it will increase interest in the brand. That could signal a rise in values. One dealer we spoke to told us that his phone was ringing off the hook in the weeks following the sale.”

One wonders then if the ten people (yes, just ten) invited to the auction of the Uhlenhaut 300 SLR and the timing of the sale were, therefore, part of a carefully structured marketing plan by the Stuttgart-based automotive giant.

HAGI – Historic Automobile Group International – are an ‘independent investment research house and think-tank with specialised expertise in the rare classic motorcar sector.’ Their Top Index – their market overview – is up 10% this year, and 2021’s numbers were up 2.73% over 2020. Their Emerging Classics Index – a look a potential future classics – was up 9.36% in 2021. This study echoes what John Mayhead at Hagerty suggested about which generation is active and which cars are in the spotlight. Their data suggests that positive movement in the prices will happen with cars relevant to today’s spenders. When asked where HAGI suggest you spend your money, “Concentrating on top quality cars would be a very good strategy.” They stress that well-documented cars and fully original examples should be your focus.

HAGI further confirms the views shared by others in this piece that the sale of the 300 SLR will positively affect the classic car market, primarily classic Mercedes Benzes and SLs. “It draws attention to the marque of Mercedes-Benz in particular, and the SLs have a heritage that goes back to the SLR.”

U.K. based Mercedes-Benz SL specialist, SLSHOP, has over 15 years’ of coalface experience in the classic Mercedes-Benz industry. Founder, Sam Bailey says, “The sale of Uhlenhaut’s 300 SL certainly marked a new era for the rarer classic cars. It may well be some time before we see a phenomenon like this again and drawing a direct correlation with the broader classic Mercedes-Benz market would be speculation at this stage.”

Bailey goes on to say, “What this moment does confirm, however, is that the rich stories, experiences and popular culture that underpin a vehicle’s existence are inseparable from a vehicle’s revered style and engineering. It is this provenance, in conjunction with the uniqueness of these particular vehicles that entices those with the fiscal power to invest in the preservation of these stellar pieces of automotive history. It is these elements that thrust Uhlenhaut’s 300 SL (as well as others) further towards the realms of rare art and, as such, are not generally indicative of the wider classic car or classic Mercedes market.”

“With that said, the fact that this vehicle was put up for auction by Stuttgart suggests a desire to reignite interest in the SL and the brand in general. And with this exposure comes a more intense spotlight on the world of the Mercedes-Benz SL. Now that the fifties SLs are scarcely available, the knock-on effect is a relentless demand for the very best successors. Where an original 280 SL five years ago would fetch circa £150,000, we are now seeing these same vehicles sell for more than £250,000. Where previously complete originality was favoured, a fully restored W113 280 SL Pagoda is now just as appealing,” said Bailey.

The 280 SL has been the flag flyer for several years, but with all three variants of the W113 (230, 250 and 280 SL) possessing the same style and solid engineering, we expect to see their values following suit. A 230 SL in all original and usable condition represents a real prospect for an enthusiast looking to invest and enjoy a classic Mercedes SL. It is highly likely that their values will reach new heights this year.

Naturally, as we move through the SL ranges and acknowledge the context in which we are reporting these increased values – climate pressures, post-pandemic economic pressure and war – it is becoming clearer that all age groups are seeking out the spiritual and financial opportunities offered by a classic Mercedes-Benz. The late eighties and nineties SLs are not yet out of reach of the millennials and can be discovered through a whole host of digital platforms, making the transaction a much more fluid process. This move away from closed-door auctions is going to create a more accessible environment for aspiring owners and consequently may encourage the price of the more modern SLs to move upwards.

There is clear daylight between the handful of folks who might consider an ultra-rare, ballistically expensive crown jewel like the Uhlenhaut 300 SLR, and the rest of the classic car enthusiast community. Most of us are looking for something cool, something beautiful, for reasonable money. SLSHOP adds an important element to this list of criteria. The car you buy should be usable on an almost day-to-day basis, and it should be driven. Often.

The beauty of building a relationship with SLSHOP is they have the expertise to help you keep your SL or other classic Mercedes-Benz valuable, reliable and on the road.

There’s always an easy argument to be made, among motoring enthusiasts, for finding a beautiful old car and rolling it onto your driveway. If you’re able to do that knowing you’re also making a sound financial decision, then perhaps that search can begin today.

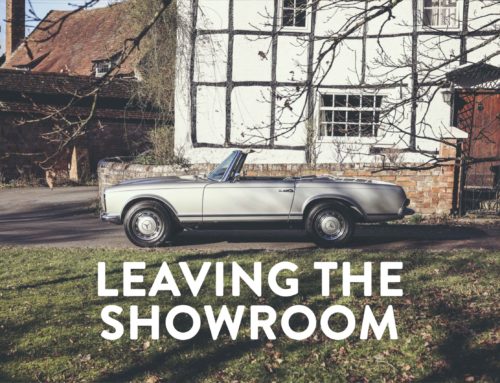

Thanks to careful curation, we have our best ever selection of SLs in the showroom at the moment. There is a vast choice of colours, trims, engines and specifications, as well as price points, from across the Mercedes-Benz SL back catalogue. Bruce is available to discuss any of these amazing motor cars and is more than happy to host our car consultancy over the phone, using FaceTime or other digital formats. SLSHOP are offering all buyers free secure storage until we’re able to hand you over the keys for that, oh so, important first drive.

Share With Your Fellow Enthusiasts

The world’s most valuable car is a Mercedes-Benz. Where will your investment money go?

Kieran Rennie speaks to a number of key industry players on behalf of SLSHOP.

It isn’t just the staggering sales figure; it’s also the massive price difference between this new record and the old one. Mercedes Benz hasn’t just moved the needle; they’ve broken the pin at 8000 rpm mark.

The 1956 Mercedes-Benz 300 SLR – of which only two were made – sold for a jaw-dropping $142.7 million, more than doubling the old record. The previous champion, a 1964 Ferrari GTO, held the title at $70 million. The Italian manufacturer had been top of the pops for some time with a succession of (mainly) 250 GTOs. The 300 SLR has landed a knockout blow the likes of which no one, perhaps not even the Mercedes Benz Museum – who put the car up for sale – could have predicted.

While cars like the 300 SLR – and the associated asking prices – exist almost entirely in Bezos-Musk-Ville, it is a significant moment for the automotive landscape. It stirs interest, ignites conversations, and it affects values.

RM Sotheby’s, who facilitated the sale, are, unsurprisingly, still basking in the glory. Peter Haynes, Marketing and Communications Director EMEA, says, “Words can’t really do justice to the importance and significance of this sale. It’s reasonable to say that nobody ever imagined that this car would ever be offered for sale, so for Mercedes-Benz to ask RM Sotheby’s to conduct the auction was an absolute honour. It is clear that the sale of this car is a game-changer in the collector car market and has, naturally, forced people to re-assess the values that can be attributed to cars which sit amongst the rarest and most historically significant examples in the world. But it may be many years before we see a sale of another car that can compare to this remarkable event.”

For some time now, classic cars have been considered legitimate investments. In the same way that one might buy a rare painting by a famous artist, a rare and sought-after car can be fun to own and financially prudent. Whether you’re a member of the world’s financial elite or just someone with a bit of expendable income looking to be smart with your money, buying the right classic car is a sensible economic strategy. And it doesn’t have to be a multi-million dollar, uber-rare Mercedes or Ferrari. An early model VW Beetle, as an example, bought for say £7000 ten years ago, might be worth double that today if you’ve managed to keep the car in good nick.

The trick is, as with any investment, finding the right car. In the case of the Uhlenhaut 300 SLR – named after the then head of testing at Mercedes Benz, Rudolph Uhlenhaut – or a Ferrari 250 GTO, the car’s rarity, its motorsport heritage, and the brand’s providence make it an easy pick. But that ‘certainly’ comes at a price. How does one find an affordable car that offers some degree of confidence in its future value?

The recent inaugural Concourse On Savile Row, held on that famous, high-end men’s fashion street in London, had on display an impressive selection of future, contemporary and classic cars. Many of these cars were limited-production models made even more exclusive by independent automotive design houses. From both a financial and a passion perspective, there is a growing appetite for cars that are already pricy from the manufacturer, customised to bespoke specifications – the cost of which can often double the purchase price. These owners – these investors – are confident that the one-off nature of their new car will retain and even increase its value based on its uniqueness.

When asked his opinion about the sale of the 300 SLR, Geoff Love, Managing Director of Hothouse Media and co-organiser of the Concourse, had this to say: “The price paid for the Mercedes-Benz reflected the unique nature of the individual car. In my view, it will challenge the valuations of the most important classic cars that transcend automotive culture and move them into fine art. It will raise the bar for the absolute very best cars of real provenance rather than have a general impact on all classic cars. It may move the general value of certain classic Mercedes, but the real winners will be those rare cars that are rolling works of art.”

Rudolph Uhlenhaut

There is no doubt that beauty, style, grace and sex appeal all play a part in a car’s desirability. And even though beauty is in the eye of the beholder, and sometimes even the beer holder, there are some cars that the vast majority of people, car lovers or not, agree would look great in their driveway. There’s no doubt that the estimated 5000 folks who attended Concourse On Savile Row found reason to stop and stare and drool.

Disappointingly, there were no SLs or other classic or contemporary Mercedes-Benz’s on display at the Concourse. We now live in a world where the ‘world’s most valuable car’ is a Mercedes-Benz SL. Any collection or display of desirable cars feels a little empty without a three-pointed star on the grounds. One suspects that if the timing of event wasn’t as close as it was to the record-breaking auction of the 300 SLR, that we may well have seen a slightly different line-up.

Hagerty is a world-renowned classic car insurer and valuations expert. Their Classic Index tracks the values of 50 individual cars. This index analyses the ‘gold standard’ landscape and can, therefore, to a degree, give solid insights into the future developments of the U.K. and world markets.

John Mayhead, Editor of the UK Hagerty Price Guide, said, “In general, the old ‘gold standard’ classics have been either flat or reduced in value: pre-1970s Aston Martins, E-Type Jaguars, Jensen Interceptors, etc. have all slipped back, except very special cars (matching numbers, interesting provenance, originality, good spec and colour). Hagerty believes that if you were of the generation that remembers the impact a DB5 or an E-Type had when new, you’ve either reached the point in your life when you can afford one, or you never will.”

We asked John about his views on future classic Mercedes-Benz models. He said: “Early AMG Mercedes saloons (C36, C43, E55, etc.) are likely to rise if in good condition. Similarly, any well-maintained Black Series cars are already very collectable. SLS and SLR McLarens have both recently been added to the Hagerty Price Guide for the same reason.”

Mayhead feels that the cars that are growing in value – apart from the unicorns – are vehicles relevant to the generation which is enthusiastic about spending their money today. The baby boomers have perhaps already bought the cars they want. Gen X and even the millennials have their faces planted to the windows of today’s digital showrooms. It’s their hero cars, therefore, which are gaining momentum.

Mayhead also says, “At the top end, there seems to be a US-led surge in the values of 300SL Gullwing and Roadsters. Values dipped just before the pandemic but have rallied strongly. We’ve seen a 22% increase in average Gullwing value (to £1.131M) in the last three years.”

“The W121 190SL has also performed extremely well with a rise of 18% over the same period (avg. now £119,000). W113 230SL and 280SL have been increasing steadily but feel undervalued: they combine classic styling with a driving practicality that puts them in a very usable category.”

With the W113 SL, The Pagoda, set for its 60th anniversary next year, right now could be the perfect time to snap one up. The 280SL has always been the ‘one to buy’, but both the 250SL and the 230SL are now gaining momentum.

We also asked John for final comments on the sale of the 300 SLR and whether moments like this will impact overall prices, “We think not directly. Industry insiders suggest that this is a strong play by MB, though – to make the point that their car is the most valuable in the world. Coming so close to the release of the AMG One (Hypercar), it is a statement of intent to the opposition. This is such a high level of sale that it is unlikely to directly increase other MB prices, but it will increase interest in the brand. That could signal a rise in values. One dealer we spoke to told us that his phone was ringing off the hook in the weeks following the sale.”

One wonders then if the ten people (yes, just ten) invited to the auction of the Uhlenhaut 300 SLR and the timing of the sale were, therefore, part of a carefully structured marketing plan by the Stuttgart-based automotive giant.

HAGI – Historic Automobile Group International – are an ‘independent investment research house and think-tank with specialised expertise in the rare classic motorcar sector.’ Their Top Index – their market overview – is up 10% this year, and 2021’s numbers were up 2.73% over 2020. Their Emerging Classics Index – a look a potential future classics – was up 9.36% in 2021. This study echoes what John Mayhead at Hagerty suggested about which generation is active and which cars are in the spotlight. Their data suggests that positive movement in the prices will happen with cars relevant to today’s spenders. When asked where HAGI suggest you spend your money, “Concentrating on top quality cars would be a very good strategy.” They stress that well-documented cars and fully original examples should be your focus.

HAGI further confirms the views shared by others in this piece that the sale of the 300 SLR will positively affect the classic car market, primarily classic Mercedes Benzes and SLs. “It draws attention to the marque of Mercedes-Benz in particular, and the SLs have a heritage that goes back to the SLR.”

U.K. based Mercedes-Benz SL specialist, SLSHOP, has over 15 years’ of coalface experience in the classic Mercedes-Benz industry. Founder, Sam Bailey says, “The sale of Uhlenhaut’s 300 SL certainly marked a new era for the rarer classic cars. It may well be some time before we see a phenomenon like this again and drawing a direct correlation with the broader classic Mercedes-Benz market would be speculation at this stage.”

Bailey goes on to say, “What this moment does confirm, however, is that the rich stories, experiences and popular culture that underpin a vehicle’s existence are inseparable from a vehicle’s revered style and engineering. It is this provenance, in conjunction with the uniqueness of these particular vehicles that entices those with the fiscal power to invest in the preservation of these stellar pieces of automotive history. It is these elements that thrust Uhlenhaut’s 300 SL (as well as others) further towards the realms of rare art and, as such, are not generally indicative of the wider classic car or classic Mercedes market.”

“With that said, the fact that this vehicle was put up for auction by Stuttgart suggests a desire to reignite interest in the SL and the brand in general. And with this exposure comes a more intense spotlight on the world of the Mercedes-Benz SL. Now that the fifties SLs are scarcely available, the knock-on effect is a relentless demand for the very best successors. Where an original 280 SL five years ago would fetch circa £150,000, we are now seeing these same vehicles sell for more than £250,000. Where previously complete originality was favoured, a fully restored W113 280 SL Pagoda is now just as appealing,” said Bailey.

The 280 SL has been the flag flyer for several years, but with all three variants of the W113 (230, 250 and 280 SL) possessing the same style and solid engineering, we expect to see their values following suit. A 230 SL in all original and usable condition represents a real prospect for an enthusiast looking to invest and enjoy a classic Mercedes SL. It is highly likely that their values will reach new heights this year.

Naturally, as we move through the SL ranges and acknowledge the context in which we are reporting these increased values – climate pressures, post-pandemic economic pressure and war – it is becoming clearer that all age groups are seeking out the spiritual and financial opportunities offered by a classic Mercedes-Benz. The late eighties and nineties SLs are not yet out of reach of the millennials and can be discovered through a whole host of digital platforms, making the transaction a much more fluid process. This move away from closed-door auctions is going to create a more accessible environment for aspiring owners and consequently may encourage the price of the more modern SLs to move upwards.

There is clear daylight between the handful of folks who might consider an ultra-rare, ballistically expensive crown jewel like the Uhlenhaut 300 SLR, and the rest of the classic car enthusiast community. Most of us are looking for something cool, something beautiful, for reasonable money. SLSHOP adds an important element to this list of criteria. The car you buy should be usable on an almost day-to-day basis, and it should be driven. Often.

The beauty of building a relationship with SLSHOP is they have the expertise to help you keep your SL or other classic Mercedes-Benz valuable, reliable and on the road.

There’s always an easy argument to be made, among motoring enthusiasts, for finding a beautiful old car and rolling it onto your driveway. If you’re able to do that knowing you’re also making a sound financial decision, then perhaps that search can begin today.

Thanks to careful curation, we have our best ever selection of SLs in the showroom at the moment. There is a vast choice of colours, trims, engines and specifications, as well as price points, from across the Mercedes-Benz SL back catalogue. Bruce is available to discuss any of these amazing motor cars and is more than happy to host our car consultancy over the phone, using FaceTime or other digital formats. SLSHOP are offering all buyers free secure storage until we’re able to hand you over the keys for that, oh so, important first drive.

Share With Your Fellow Enthusiasts

More from Journal

CARE

THE ULTIMATE CERTIFIED SERVICING INVESTMENT PLAN

Your ownership journey matters to us, which is why we have created a simple certified servicing investment plan, tailored to your individual needs and aspirations.

Start investing today and our dedicated CARE team will work with you to increase the value and enjoyment you receive from your vehicle.

STAY IN TUNE WITH SLSHOP MOMENTS

As part of SLSHOP’s community of enthusiasts, you’ll be the first to hear about events and tours, key product offers, exciting stories from owners around the world and of course… our latest additions to the showroom. So, be the first to know and you might just sneak a car on your driveway or take your car’s condition to new heights with our exclusive replacement parts.

Or, visit SLSHOP Journal